Debt recovery is no longer what it used to be. For decades, collection agencies and their creditor clients operated largely with manual tasks: phone calls, letters, spreadsheets, and piles of paper. In today’s fast-moving, highly regulated world, these traditional practices create inefficiencies, compliance risk, and poor customer experience. Creditors demand better outcomes, regulators require more transparency, and consumers expect more convenience.

A Spire collection agency that leans into technology and automation can meet all these demands, without undermining compliance or sacrificing human touch. Modern systems can handle repetitive work, track every interaction, score accounts by risk and behavior, guide agents in real time, and much more. The result: faster recovery, lower cost, better record-keeping, and a stronger reputation.

In this post, we examine how technology is reshaping debt recovery workflows, what the core components are, how to scale responsibly, and what challenges to watch. We also lay out a practical implementation roadmap and the strategic benefits automation brings to both agencies and their creditor clients.

The Case for a Tech-First Recovery Approach

Regulatory & Operational Pressure

Debt recovery is under constant regulatory scrutiny, and creditors face mounting operational pressure. Rules about communication timing, consumer rights, dispute resolution, debt validation, and consent are increasingly strict. Failure to follow them can lead to legal penalties, reputational damage, and financial loss.

At the same time, account volumes are rising. Many creditors — such as banks, fintechs, medical providers, utilities, and telecoms — place more accounts with third-party agencies. These agencies must scale operations without breaking the law or overburdening their collections teams. Manual processes that once “just worked” are no longer sufficient.

Rising Consumer Expectations

Modern consumers expect digital, frictionless experiences. They are comfortable paying bills online, setting up payment plans via apps, and receiving texts or emails. They also care about transparency. When they dispute a debt, they expect prompt acknowledgment, clear documentation, and a resolution — not endless delays or confusion.

Collection workflows that fail to match these expectations risk low engagement, high dispute rates, and negative sentiment. Using outdated/manual methods alone can frustrate consumers and reduce the effectiveness of outreach.

The Documentation Imperative

Accurate documentation isn’t just a compliance checkbox; it’s a strategic asset. Every contact, promise to pay, payment, dispute correspondence, and internal decision must be tracked precisely. Without robust records, a Spire collection agency puts itself and its creditor clients at risk in case of audits, litigation, or regulatory scrutiny.

Poor record-keeping can also lead to:

- Disputes are being rejected because the proof is weak

- Consumer complaints stemming from miscommunication

- Compliance violations from missing audit trails

- Lost revenue due to inefficiencies

This is where technology and automation become invaluable. When workflows are digitized, data is consistently captured, structured, and stored — ready for analysis or defense.

Core Pillars of Technology-Driven Recovery Workflows

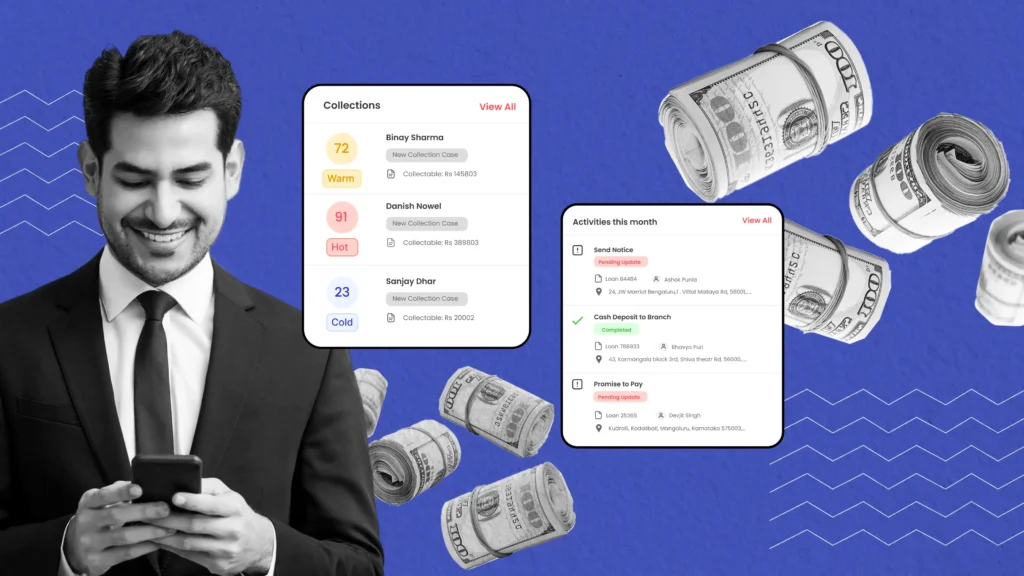

To deliver real value, automation should focus on four main pillars: predictive analytics, omnichannel communication, self-service/payment portals, and compliance automation. Together, these components propel a modern, efficient, and consumer-friendly recovery operation.

Predictive Analytics: Scoring for Strategy

Not all debt accounts are equal. Some are likely to pay soon; others may never pay. Predictive analytics helps collection teams distinguish between them.

By applying machine learning models to historical and real-time data — such as payment behavior, contact response, time since default, balance size, and even demographic or behavioral signals, agencies can:

- Score accounts by risk or payment likelihood: High-probability accounts get prioritized.

- Dynamically adjust strategies: If a debtor shows recent engagement, the system can escalate outreach or offer a better plan.

- Optimize resource allocation: Agents spend time on accounts with the highest payoff.

This results in significantly higher recovery efficiency and return on investment. Rather than scattering outreach broadly, agencies focus where success is most likely, reducing wasted effort and boosting cash flow.

Omnichannel, Personalized Outreach

Modern debtors live across multiple channels: phone, SMS, email, secure portals, and more. A technology-enabled recovery workflow uses an omnichannel approach, dynamically shifting methods based on what works best.

Consider these scenarios:

- A debtor reads an email about their balance but doesn’t click “Pay Now.” The system could automatically send a text message with a link to the portal.

- A phone call goes unanswered. The system triggers a follow-up via secure letter or chatbot.

- A consumer clicks into a payment portal but abandons before completing a plan. The system can send a reminder during peak responsiveness hours.

Automated sequencing rules (based on behavior and preference) ensure messages land in the right format, tone, and timing. This improves engagement, reduces frustration, and increases the likelihood of resolution. Importantly, the system tracks all of these steps, building a full, audit-ready interaction history.

Self-Service Payment Portals

Digital payment portals empower debtors to resolve accounts on their terms. These portals typically offer features such as:

- Viewing balances and transaction history

- Setting up payment plans (weekly, monthly, or custom)

- Making one-time or recurring payments

- Downloading statements or payoff letters

- Checking past communications and agreements

For many consumers, portals are far more convenient than phone calls. They can operate outside business hours and at their own pace. For agencies, portals reduce inbound call volume and free agents from routine transactional tasks.

Moreover, automation can suggest optimal payment plans based on a consumer’s history or credit profile. By offering plans that match real affordability, agencies can improve plan acceptance and reduce default risk. All portal interactions are recorded, creating precise documentation of debtor behavior and commitments.

Compliance Automation & Risk Management

Compliance is non-negotiable in debt recovery. Technology helps ensure that every step of the interaction fully aligns with rules, standards, and audit expectations.

Automated systems enforce compliance in the following ways:

- Policy-based outreach: Systems restrict communication to allowed hours, prevent prohibited content, and respect do-not-call or do-not-text preferences.

- Consent tracking: Automated mechanisms ensure that consent is captured, stored, and honored across all channels.

- Audit trails: Every interaction — voice call, SMS, portal login, payoff — is logged with timestamps and metadata.

- Exception alerts: If a risky event occurs (e.g., excessive disputing, a legal escalation), the system flags it for supervisory review immediately.

By embedding compliance within the workflow, agencies reduce legal risk and protect both their own operations and the reputation of their creditor clients.

Advanced Automation: Beyond Basic Workflows

Modern debt recovery platforms go far beyond reminders and follow-ups. They incorporate advanced AI, document-processing, and negotiation systems to make workflows smarter, faster, and more scalable.

AI Voice Agents & Conversational Automation

Voice AI has evolved. Intelligent voice agents can now handle a wide variety of tasks:

- Outbound dialing to verify identity

- Calibrated negotiation scripts (based on past behavior)

- Payment plan offers and setup

- Secure payment collection

- Confirmation and documentation

These agents operate around the clock, freeing human agents for complex or sensitive calls. When the voice AI recognizes a need for escalation — for example, when there’s emotional distress or complex negotiation — it transfers the call to a human seamlessly.

This hybrid model ensures high capacity and consistent quality without exhausting human resources. Recovery operations can scale without losing responsiveness.

Intelligent Document Processing (IDP)

Debt workflows generate large volumes of unstructured documents: contracts, proof-of-service, bills, medical statements, paystubs, correspondence, and more. Historically, teams spent countless hours manually reviewing and keying in data.

IDP technology changes that entirely. It uses optical character recognition (OCR) and natural language processing (NLP) to:

- Identify key fields in scanned or digital documents

- Extract relevant data (e.g., account number, balance, debt origination date)

- Classify document types (invoice, contract, pay stubs)

- Validate data against existing records

This automation reduces errors, speeds upthe onboarding of accounts, and ensures that all relevant documentation is accurately stored. It also helps agents respond quickly in dispute situations with context-rich information.

Generative AI & Agent Guidance

Generative AI (based on large language models) can assist agents in real time, improving consistency while reducing training burden. These systems can:

- Draft email or letter responses aligned with legal and compliance constraints

- Suggest optimal negotiation language for payment plans

- Provide rebuttal scripts for common objections

- Propose empathetic and legally sound language during calls

The agent reviews and refines the output, ensuring a human stays in control. This support speeds up responses, improves quality, and helps newer agents act confidently.

Scaling Operations — While Keeping the Human Touch

Automation isn’t about removing humans from the process. It’s about making their work more meaningful and effective.

Hybrid Agent + Automation Model

To scale operations responsibly, a Spire collection agency should adopt a hybrid model:

- Automation handles routine tasks: reminders, payment-plan suggestions, basic outreach.

- Human agents handle complex, emotional, or high-risk cases: disputes, negotiation, hardship, complaints.

- AI assistance supports agents: real-time guidance, sentiment analysis, optimal script recommendations.

This ensures efficiency without sacrificing empathy.

Real-Time Performance Dashboards

Modern platforms provide dashboards that give supervisors and team leads clear visibility into:

- Recovery KPIs (promise-to-pay rates, plan acceptance, cash collected)

- Agent productivity (calls made, disposition outcomes)

- Compliance metrics (flags, escalations, audit issues)

- Consumer satisfaction (portal activity, payment behavior)

These dashboards allow data-based decision-making, continuous process improvement, and rapid response to risk events.

Implementation Strategy: How a Spire Collection Agency Can Adopt Automation

Adopting these tools doesn’t mean ripping out everything at once. A phased approach reduces risk and maximizes ROI.

Phase 1: Discovery & Audit

- Workflow map: Document current processes, who does what, and where manual effort is highest.

- Gap analysis: Identify compliance risk points, inefficiencies, documentation gaps.

- Account segmentation: Understand which segment (by balance, age, consumer type) might benefit most from automation.

- Stakeholder alignment: Bring together operations, compliance, IT, and account managers to build shared goals.

Phase 2: Pilot Program

- Select a pilot cohort: Choose a representative sample of accounts (by size, risk, age).

- Implement core automation features: Could include predictive scoring, portal access, automated outreach, or voice agents.

- Monitor metrics: Track recovery rates, agent time saved, compliance flags, consumer feedback.

- Iterate: Make adjustments based on pilot outcomes — refine scripts, adjust scoring models, fine-tune compliance rules.

Phase 3: Full-Scale Deployment

- Roll out across portfolio: Gradually expand automation tools across all accounts as confidence grows.

- Train agents and supervisors: Teach staff how to work with the technology. Emphasize the new hybrid model.

- Governance: Establish a cross-functional governance team (operations + compliance + data) to manage system rules, exceptions, and escalations.

- Measure and optimize: Use dashboards and KPIs to continuously improve performance. Adjust models, channels, and scripts based on real-world data.

Risks and Ethical Considerations

While automation offers great benefits, there are important risks and ethical concerns to manage.

Risk of Impersonal or Aggressive Automation

If overused, automated outreach can feel impersonal or punitive. That can alienate consumers, escalate complaints, or damage brand reputation. Agencies must carefully design escalation rules so that automation hands off to humans when empathy or negotiation is required.

Data Privacy and Security

Debt collection involves handling very sensitive data: income, balance, personal contact information, transaction history. It’s critical to build robust data protections:

- Encrypt data at rest and in transit

- Apply access controls and role-based permissions

- Implement detailed audit logs and traceability

- Regularly assess and update security posture

Well-designed systems should also support data minimization and retention policies, ensuring you only keep what is necessary and retain it for only as long as legally required.

Maintaining Transparency and Consumer Trust

Consumers may feel uneasy when AI or automated systems call them or send messages. To maintain trust:

- Clearly disclose who (or what) is contacting them.

- Use language that explains they’re interacting with a system.

- Provide opt-out or escalation routes to human agents.

- Offer transparent explanations of payment plan offers or negotiation proposals.

Transparency builds respect and reduces the risk of mistrust or compliance complaints.

Navigating Regulatory Change

Regulations governing debt collection can shift quickly. Your automation systems must be flexible enough to adapt. Policies for escalation, communication limits, and consent must be regularly reviewed. Maintain a compliance governance team that can quickly update workflows, scripts, and system rules when regulation changes.

The Future of Automated Debt Recovery

The future of debt recovery looks even more intelligent and seamless than what we see today. Emerging trends to watch include:

- Hyper-automation: Combining robotic process automation (RPA), IDP, AI, and orchestration to create fully automated, end-to-end recovery pipelines.

- Adaptive negotiation agents: AI systems that run multi-channel, multi-step negotiation flows, dynamically adjusting strategy based on consumer behavior.

- Behavioral prediction at scale: Predictive models that incorporate macroeconomic indicators, consumer sentiment data, and portfolio-level dynamics to forecast payment trends.

- Natural voice AI: Generative voice agents that speak more naturally, understand complex consumer statements, and escalate with empathy.

- Embedded consumer financial wellness tools: Integration of payment portals with budgeting or credit-building tools, offering a more supportive customer experience.

Agencies and creditors that begin investing now will be well-positioned for tomorrow’s recovery environment. Early adoption will yield competitive advantage, operational resilience, and stronger compliance posture.

Strategic Benefits for Spire Collection Agencies

By embracing these modern technologies, a Spire collection agency can:

- Boost recovery performance: Better targeting, smarter outreach, and more efficient workflows lead to higher collection rates.

- Reduce operating cost: Automation frees up human agents from transactional tasks, reducing labor cost and scaling capacity.

- Improve compliance posture: Automated logs, policy-driven actions, and audit-ready documentation all reduce regulatory risk.

- Strengthen client trust: Creditor partners (banks, fintechs, medical providers, retailers) will value the transparency, accuracy, and professionalism automation delivers.

- Enhance consumer experience: Self-service portals and empathetic AI preserve dignity, reduce friction, and build goodwill.

- Future-proof operations: Technology prepares the agency for evolving regulation, changing consumer behavior, and shifting macro conditions.

Conclusion

Technology and automation aren’t just nice-to-have tools for debt recovery. There is a fundamental shift in how modern collection teams operate. For a Spire collection agency, adopting intelligent systems means more than scaling: it means becoming more accurate, compliant, transparent, and consumer-centric.

By investing in predictive analytics, omnichannel outreach, self-service portals, AI voice agents, intelligent document processing, and real-time decision support, agencies can achieve:

- Faster recoveries

- Lower costs

- Stronger documentation and audit trails

- Better compliance outcomes

- Improved consumer satisfaction

The path forward demands a thoughtful, phased implementation. But the rewards are clear: operational efficiency, client confidence, and resilience in a rapidly changing industry.

As the recovery industry continues to digitize, the agencies and creditors that embrace automation today will lead tomorrow. Technology is no longer a back-office enabler — it is the central engine for modern, ethical, and effective debt recovery.