In today’s innovation-driven economy, patents are more than legal shields; they are strategic financial assets. For tech companies, startups, and research institutions, finding ways to monetize patents effectively has become central to sustaining growth and staying competitive.

But effective monetization requires more than ownership; it demands structured strategies, smart positioning, and a keen understanding of evolving markets.

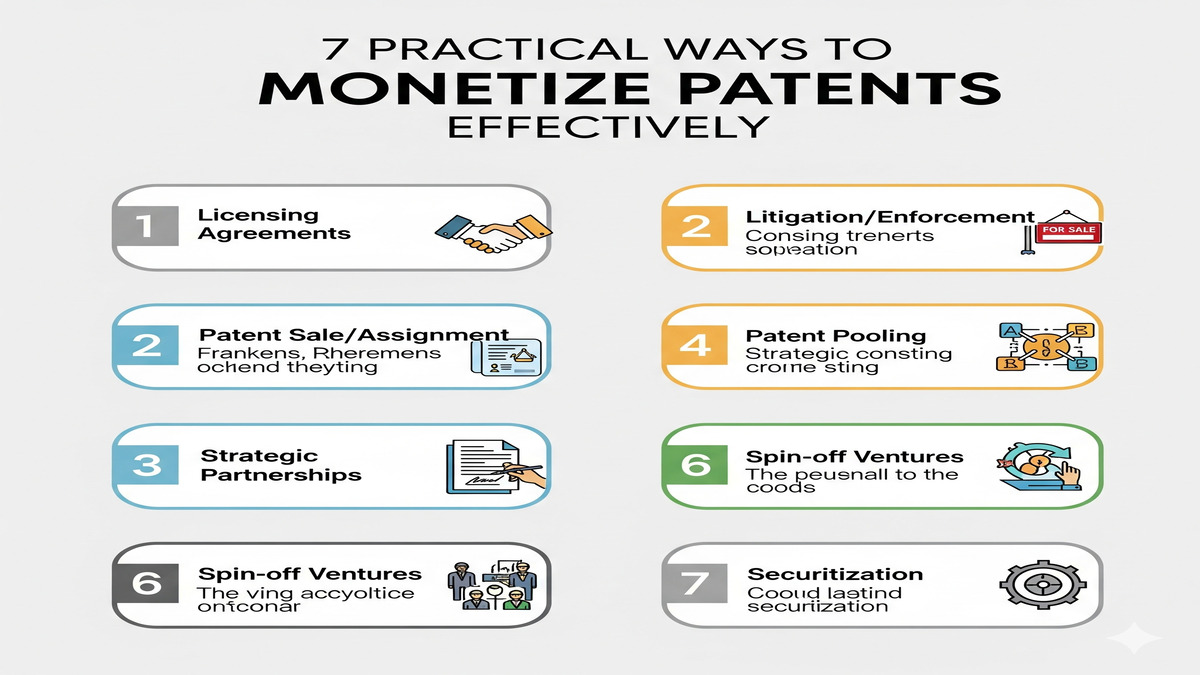

The 7 Practical Ways to Effectively Monetise Patents

This editorial explores seven practical approaches that leading companies use to transform patents into measurable financial outcomes — blending actionable tactics with insights from high-impact case studies.

1. Licensing Patents for Recurring Revenue

Patent licensing remains the most stable and scalable way to monetize intellectual property. By granting others the right to use patented technologies, companies generate royalties, upfront fees, or milestone-based payments all while retaining ownership.

Two dominant licensing structures:

- Exclusive Licensing: One licensee gets full commercial rights, typically resulting in higher payouts.

- Non-Exclusive Licensing: Multiple licensees benefit, expanding reach and recurring income potential.

Real-world example: Qualcomm’s patent licensing model has generated billions annually, making it a blueprint for tech firms looking to maximize IP value. In pharmaceuticals, where patents govern billion-dollar drug pipelines, licensing accelerates market entry while reducing R&D burdens.

Pro tip: Conduct thorough due diligence on potential licensees to ensure compliance, performance, and brand alignment.

2. Selling Patents for Immediate Liquidity

Sometimes, immediate capital outweighs long-term licensing gains. Selling patents outright is ideal when:

- The patent no longer aligns with your core business.

- Competitors can commercialize the technology faster.

- Cash flow is needed to fund critical innovation.

Patent marketplaces like IAM Market and specialized brokers connect inventors with buyers globally, streamlining negotiations.

For instance, in the 5G wireless race, tech giants aggressively purchase patents from startups to strengthen their positions transactions that often fetch multi-million-dollar valuations. While selling forfeits future royalties, it provides fast liquidity and simplifies balance sheets.

3. Using Patents to Boost M&A Value

Patents aren’t just innovation markers — they’re negotiation leverage. A strong IP portfolio can significantly enhance a company’s valuation during mergers and acquisitions. Buyers view patents as competitive moats, protecting products and enabling long-term market dominance.

Startups with strategically aligned patents often secure premium valuations. Case in point: Google’s $12.5 billion acquisition of Motorola Mobility in 2012. The deal wasn’t about smartphones it was about gaining access to over 17,000 patents critical to Android’s global growth.

Insight: Companies looking to position themselves for acquisition should focus on building high-value patents in emerging technologies where demand outpaces supply.

4. Enforcing Patents Through Litigation

When competitors infringe, litigation becomes a high-stakes monetization strategy. While costly, successful enforcement can result in massive settlements, licensing deals, or court-awarded damages.

For effective litigation-driven monetization:

- Run comprehensive technical analyses to prove infringement.

- Engage patent litigation experts early in the process.

- Explore third-party litigation funding to offset upfront legal costs.

Take Apple vs. Samsung (2011): Apple secured over $1 billion in damages by proving smartphone design infringements. Beyond financial recovery, such cases deter future violations and strengthen brand control.

Caution: Litigation works best for high-value patents in markets where stakes justify the costs.

5. Using Patents as Collateral for Financing

Patents are now recognized as bankable assets in corporate finance. Companies use them to:

- Secure loans from institutional lenders

- Negotiate better credit terms

- Attract venture capital while retaining equity

For startups strapped for cash but rich in innovation, this strategy unlocks capital without diluting ownership. Valuation accuracy, however, is key. Lenders demand comprehensive market analyses to assess potential ROI.

Example: In 2018, Kodak used its patent portfolio to secure financing for its shift into digital imaging. By aligning patents with growth narratives, companies unlock funding streams that fuel R&D and expansion.

6. Technology Transfer Agreements

Technology transfer enables innovators to hand off patents to organizations better positioned to commercialize them. Universities, research labs, and startups frequently partner with corporations capable of manufacturing, distributing, and scaling patented inventions.

This model thrives in sectors like biotechnology, clean energy, and advanced materials, where the cost of market entry is high but demand is soaring. For instance, academic institutions like MIT and Stanford generate significant revenues annually from tech transfer deals, transforming dormant research into market-ready solutions.

Beyond revenue, tech transfers foster cross-industry collaborations, accelerate time-to-market, and increase patent utilization rates.

7. Building Strategic Partnerships Around Patents

In industries where ecosystems evolve rapidly, collaboration outpaces competition. By forming strategic alliances, companies can pool patents, co-develop platforms, or enter adjacent markets without shouldering the full cost of innovation.

Two effective partnership models:

- Joint Ventures: Share R&D costs and divide commercial returns.

- Cross-Licensing Agreements: Allow mutual use of complementary patents, enabling rapid innovation cycles.

Example: Tesla’s decision to open its EV patents fostered an ecosystem of electric vehicle innovations, accelerating adoption while positioning Tesla as the industry standard. Strategic partnerships not only unlock new revenue streams but also shape entire industries.

Why Patent Monetization Needs Strategy, Not Guesswork

Many businesses underestimate the long-term value curve of patents. A single asset can appreciate dramatically if held until the right market conditions arise.

For example, patents in AI-driven healthcare diagnostics were undervalued five years ago, but today they’re commanding multi-million-dollar deals as demand surges globally.

Similarly, companies must anticipate regulatory shifts and competitor activity. A patent that looks commercially irrelevant today might become critical when new compliance frameworks, tech breakthroughs, or market consolidations emerge. Smart monetization strategies require continuous reassessment, not one-time planning.

The most successful companies approach patent monetization strategically, guided by three core practices:

- Conduct Regular IP Audits

Companies often hold dozens, if not hundreds, of dormant patents that never make it into products. By running structured IP audits, businesses can map unused assets, evaluate their relevance, and identify revenue opportunities that might otherwise go unnoticed. IBM, for example, routinely reviews its portfolio and licenses non-core patents, generating over $1 billion annually.

- Align Monetization Tactics With Business Priorities

Monetizing patents isn’t just about revenue; it’s about positioning. A company entering new markets may prefer cross-licensing agreements, while another in need of liquidity may prioritize direct sales. Without alignment, businesses risk depleting strategic assets too early or locking themselves out of emerging sectors.

- Combine Legal, Financial, and Technical Expertise

Patent monetization sits at the crossroads of law, technology, and business. Companies that integrate insights from IP lawyers, market analysts, and R&D leaders reduce risks, strengthen negotiations, and unlock better valuations. For high-value patents, multidisciplinary decision-making is non-negotiable.

Patents are living assets. Their worth rises and falls with market demand, competitive shifts, and execution speed. Without a deliberate strategy, companies risk underselling valuable innovations, missing licensing opportunities, or being blindsided by aggressive competitors. In an era where innovation cycles are accelerating, guesswork is expensive and often irreversible.

Final Thoughts

Patents are no longer static pieces of paperwork filed away in legal departments; they are growth engines that define competitive advantage. The companies leading today’s innovation economy, from Tesla to Qualcomm, treat intellectual property as a business asset, not a legal formality.

By applying these seven practical ways to monetize patents effectively, businesses can unlock recurring revenue, secure funding, and fuel expansion into new markets. But monetization isn’t just about extracting value it’s about amplifying impact. Every decision, from licensing to litigation, shapes a company’s position in the global innovation landscape.

In an increasingly competitive environment, patents can make the difference between being a market leader and falling behind the curve. When used strategically, they attract investors, strengthen partnerships, and open doors to cross-industry collaborations.

The takeaway is simple: patent monetization demands intent, timing, and precision. Companies that master this balance won’t just protect their ideas — they’ll transform them into lasting market power.